- +91 86189 39561

-

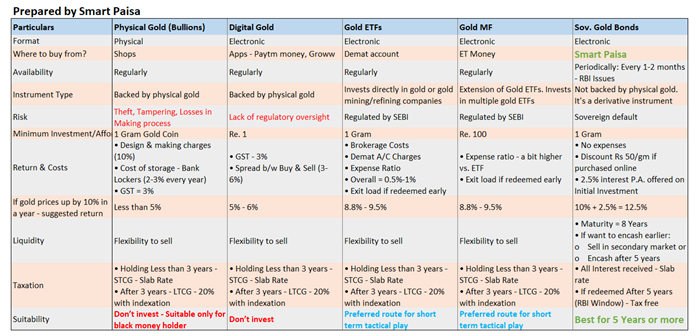

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold. They are issued by the Reserve Bank of India (RBI) on behalf of the Government of India. SGBs are an alternative investment option for those who want to invest in gold without the need to physically own and store the gold.

SGBs were first introduced in 2015 as part of the Government of India's Gold Monetization Scheme. The scheme aims to reduce the demand for physical gold by providing investors with a safer and more convenient way to invest in gold.

SGBs are an attractive investment option for those who want to invest in gold but do not want to bear the cost and risk associated with storing physical gold. SGBs also offer a fixed interest rate, which is not available with physical gold. Additionally, SGBs provide tax benefits that are not available with other forms of gold investment.

In conclusion, Sovereign Gold Bonds are government securities denominated in grams of gold that offer investors a convenient and secure way to invest in gold. They offer a fixed interest rate, tax benefits, and are tradable on stock exchanges, making them an attractive investment option for those who want to diversify their investment portfolio.

We aim to provide you one stop solution. Hence, we have tied up with various CA firms who can provide you following services based your requirements.

In conclusion, CA firms in India provide a range of services related to accounting, taxation, and financial planning. It is important to choose a reputable and experienced CA firm to ensure that you receive high-quality services tailored to your specific needs.

Here are some reputable CA firms across India offering quality services. It's important to note that we don't receive any financial incentives, whether you choose to utilize their services or not. Our aim is to offer a convenient one-stop solution, leveraging our personal connections with these firms to facilitate a smoother connection for you

R N Bothra & Co

Address: 2038, Jash Market, Ring Road,

Surat Gujarat, 395002

Phone Number: 0261-4053417

Email: info@rnbothra.com

Website: www.rnbothra.com/

Experience: 10+ Years

Vagrecha and Associates

Address: No. 6, 4th floor, TMR tower,

Thubarahalli, Bangalore 560066

Phone Number: +91 99000-09025

Email: cadeepak@vagrecha.com

Website: www.vagrecha.com

Experience: 10+ Years

GGPS and Associates

Address:1157, 11-floor Spaze Itech Park, Sector 49, Gurgaon Haryana, 122018

Phone Number: +91 95300-99996

Email: Mail@catarun.com

Website: WIP

Experience: 5+ Years

V G V K & CO

Address: 116/2 4th Floor 11th Cross Malleswaram

Bangalore 560003

Phone Number: +91 97397-73322

Email: vishal@vgvkco.com

Website: www.vgvkco.com

Experience: 10+ Years

B M A & Associates

Address: Siddha Weston, 9 Weston Street First

Floor, Unit No 102, Kolkata 700013

Phone Number: +91 98831-57911

Email: mukulbihani@gmail.com

Website: WIP

Experience: 12+ Years

One Point Solution

Address:Shanti Mill Building, Ground Floor, Ram Janaki School Road, Dimapur -797112 Nagaland

Phone Number: +91 96816-65892, +91 70022-37209

Email: onepointsolutiondmr@gmail.com

Website: WIP

Experience: 10+ Years

Mahavir Colony, Lichi Gola, Purabpali, Dinajpur Road, Kishanganj, Bihar

+91 86189 39561

Copyright © Smart Paisa. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to market risks. Investors are advised to read all scheme-related documents carefully before investing. Mutual Fund schemes do not assure or guarantee any returns, and past performance may not necessarily be indicative of future results. Achievement of the investment objectives of any recommended scheme is not guaranteed.

Investors are encouraged to consider relevant factors such as applicable exit loads and the scheme’s total expense ratio (TER) at the time of investment to make informed decisions.

We offer investments in Regular Plans of Mutual Fund schemes and receive trail commissions for the services provided. Necessary disclosures regarding such commissions are shared with investors during the investment process.

AMFI Registered Mutual Fund Distributor – ARN-173755 | Date of initial registration ARN – 14-Dec-2020 | Current validity of ARN – 13-Dec-2026

Grievance Officer- Smart Paisa | contact@smartpaisa.co.in

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors